Hindenburg Strikes Again: Fresh Allegations Against SEBI Chief Amid Government Silence

New Delhi, August 2024 - The ongoing saga between Hindenburg Research and the Securities and Exchange Board of India (SEBI) took a new turn this weekend, with the short-seller leveling fresh accusations against SEBI chief Madhabi Puri Buch and her husband, Dhaval Buch. The controversy, which initially centered around the Adani Group, now involves allegations of conflicts of interest and raises questions about the transparency of the Indian markets regulator.

Hindenburg’s Fresh Allegations: Conflicts of Interest and Transparency Concerns

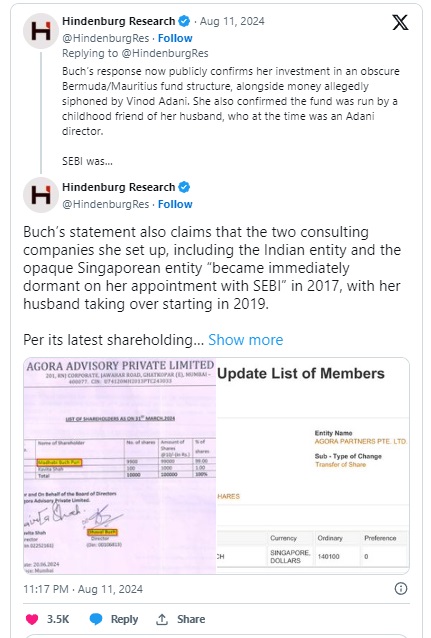

Hindenburg Research has once again put SEBI chief Madhabi Puri Buch in the spotlight, accusing her of conflicts of interest related to her investments in offshore funds based in Bermuda and Mauritius. These funds are allegedly linked to the Adani Group, specifically to Gautam Adani's brother, Vinod Adani. The short-seller's latest report claims that Madhabi Buch’s response to earlier allegations only serves to confirm her involvement in these offshore entities, which were reportedly managed by a childhood friend of her husband, who was an Adani director at the time.

Hindenburg's accusations are part of a broader critique of SEBI's handling of the investigation into the Adani Group's financial activities. The research firm has called for a full, transparent, and public investigation into the matter, questioning whether the SEBI chief can remain impartial given her personal investments in the very funds under scrutiny. The short-seller also challenged Buch to release a complete list of her consulting clients and other business engagements to clear the air.

Government Response: A Calculated Silence

Despite the escalating controversy, the Indian government has so far refrained from directly intervening. Senior officials within the government have dismissed Hindenburg's latest report as "untrue and malicious," suggesting that the short-seller's actions are a response to regulatory enforcement by SEBI. These officials allege that Hindenburg may be attempting to manipulate the Indian markets for profit.

A government source described Hindenburg's report as part of a larger effort to undermine the credibility of SEBI at a time when India’s stock market is performing well, buoyed by strong macroeconomic indicators and growth prospects. The source emphasized that the Indian markets are now robust enough to withstand such "attacks" and that SEBI has implemented numerous regulatory measures to enhance market transparency and investor protection.

SEBI’s Position and the Road Ahead

Madhabi Puri Buch, who has been SEBI chief since March 2022, has maintained that all necessary disclosures regarding her and her husband's financial interests have been made in accordance with the law. SEBI has already submitted its findings from its investigation into the Adani Group to the Supreme Court, further complicating the narrative.

As Buch approaches the end of her three-year term, with the possibility of reappointment, the market is closely watching how the government and regulatory bodies will handle these allegations. The outcome of this controversy could have significant implications not just for Buch’s career but also for the broader perception of regulatory integrity in India.